What Is an Invoice Number? How to Number Your Invoices (With Examples)

A professional invoice process makes your home service business look legit, simplifies accounting, and helps to ensure you get paid fast. Luckily, invoicing is easy to master, as long as you know what to include on your invoices and how to organize them.

One of the most important yet overlooked components is the invoice number. What is an invoice number, why are they important, and how do you generate them for your service business invoices? Read on to find out.

What is an invoice number?

An invoice number is a unique, sequential number that you assign to each of the invoices you send to clients. When used properly, invoice numbers make it easy to organize sent invoices, document your income for taxes purposes, and track incoming payments.

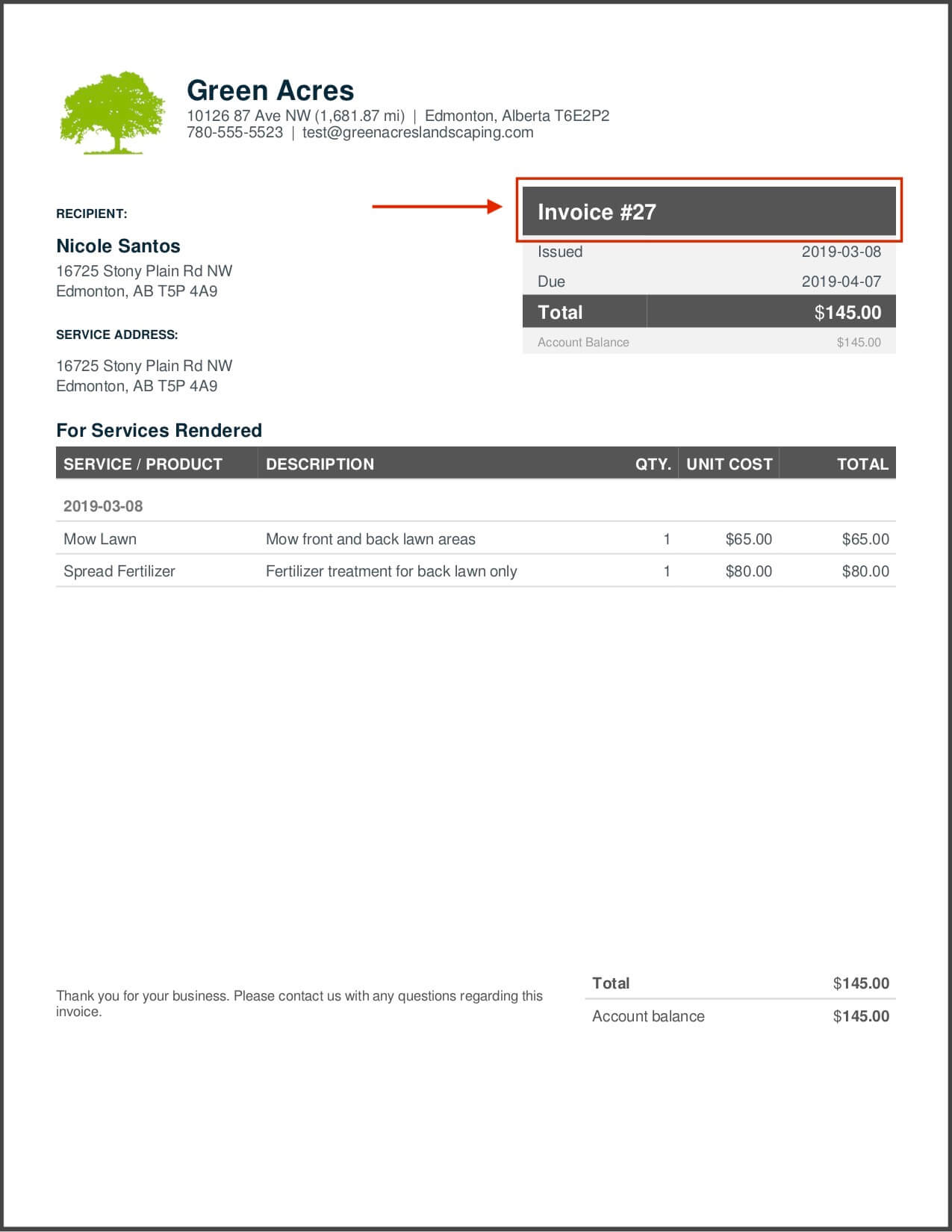

Each invoice number should be unique and clearly visible on each of your invoices. Here’s what you should know about invoice numbers:

- Invoice numbers are found at the top of the invoice

- They can be alphanumeric, including both letters and numbers (no special characters or symbols)

- Usually between 3-5 digits long

- May also include a client’s name or initials

Invoice numbers typically follow a basic numbering system, assigning a unique number to each invoice based on the invoice number format that you choose.

In some states, including invoice numbers on your invoices is a legal requirement, so if you aren’t using them already, now’s a good time to start.

READ MORE: How to make an invoice

Why are invoice numbers important?

Invoice numbers are beneficial to small business owners for many different reasons. Using a unique identifier for each new invoice can help you to:

1. Document your income for tax and accounting purposes

With multiple jobs and clients to track each year, knowing how many clients you billed and how much income you received is a major task. Because invoice numbers are sequential, they show you how many invoices you’ve sent out in a given time period and for how much.

This is especially useful for your accountant and when tax time rolls around. You’ll know exactly how many jobs you did and how much they were for, making calculating your income and tracking received payments a breeze.

READ MORE: Small business tax deductions to save money when filing

2. Organize invoices

Without invoice numbers, it’s hard to find invoices when you need them. For example, when you need to confirm a payment, answer a question from a client, or send them to your accountant.

Invoice numbers are a simple way to search through and find specific invoices, regardless of the job, customer’s name, or cost of the job. By including a unique bill number to each of your invoices, it’s easy to find the information you’re looking for in your records.

READ MORE: 5 steps on how to manage accounts receivable from an accounting expert

3. Track payments and know what you are owed

Invoice numbers are one of the best ways to track paid and unpaid invoices, and jobs. For example, with an invoice number, it’s as simple as marking Invoice #: XYZ as paid when a client sends you the total amount due.

Regardless of your payment terms, without invoice numbers, you’ll have to track payments using job details or customer contact information, which isn’t necessarily unique to each bill.

They also ensure that you don’t request duplicate payments from clients, which cause confusion and are a hassle to reverse.

READ MORE: What to do when a customer won’t pay for services

4. Boost professionalism in your business

The more organized and on the ball your service business, the more professional and legitimate you look to clients. Invoices that include an invoice number, logo, contact details, pricing information, and job specifics show clients that you take your business seriously.

How to assign invoice numbers [examples]

You can assign invoice numbers in many different ways. Some examples of the most common invoice numbering methods are:

Sequentially

An invoice number example of this format would be 1001, 1002, 1003, 1004, etc. It’s best practice to use three to four digits (like 1001 instead of 1) to avoid confusion as your business grows and you bring on more clients and jobs.

Chronologically

Chronological invoice numbers typically include the date as well as a unique invoice number so that not all invoices from the same day end up with the same number. For example, 20210531-1001, 20210531-1002, etc.

By client number

You can assign an individual number to each of your clients and use it as part of your invoice number. Let’s say you have a client named John Smith who is client number 49. A client number-based system would look like this: 49-1001, 49-1002, etc.

By project number

Similar to a client number, project numbers are unique numbers assigned to specific projects. If you were numbering a project as 299, your invoices associated with it could be 299-01, 299-02, etc.

Names and numbers

You can also mix client names and numbers. For example, BErickson1001, BErickson1002, etc.

READ MORE: Master the art of invoicing with these invoicing basics

While there are no hard and fast rules when it comes to invoicing, using a sequential (or consecutive) invoice numbering system is the easiest way to keep invoices organized and works best for avoiding duplicate invoice numbers and typos.

Regardless of which method you use, it’s best to avoid generic terms that may not be specific to particular clients in your invoice numbers. For example, a job or project name, like Mow001, could be the same for multiple invoices across different customers.

Invoice number tracking: How to make invoice numbers

Regardless of whether you’re using invoicing software or an invoice template that you update manually for each client, follow these best practices to improve your results:

- Make sure invoice numbers are easy to see and identify on each invoice

- Keep a digital record of each invoice you send (ideally in a PDF format)

- Pick a numbering method and stick with it to ensure consistency

A common way to create, store, and automate invoices is to use invoicing software. Not only will it reduce your margin for error, but it will make creating, sending, and tracking invoices faster and easier. And, the more quickly you can roll out invoices, the more likely you are to get paid on time and in full.

Invoicing software will automatically generate invoice numbers for you, helping to avoid duplicates, stick to a consistent method, and keeping you organized.

How long should I keep invoices for?

United States: The IRS recommends that you keep invoices and business records for 3-7 years in case you need them for tax purposes, such as when you file taxes or if you’re audited.

Canada: The CRA recommends you keep invoices for a period of 6 years.

United Kingdom: The HMRC recommends you keep invoices for 6 years from the end of the last financial year they relate to. You should keep them for longer if you meet certain criteria.