Online or Offline Payment: Which Method is Best for Your Small Business

There are several ways to accept payments for your services. The easiest way to understand them is by breaking them up into two types: online and offline payments. As a small business owner, you need to decide which option works for your margins, your convenience, and your customers’ payment experience.

In this article, we’re going to skip past the ins and outs of credit card processing, and talk about all the different ways your business can accept payment from your customers.

Comparing different payment methods for small businesses

| Payment method | Pro | Con |

| Cash | – You have access to funds right away. – There are no processing or deposit fees. – A preferred method for older clientele demographic. – Payments are in hand, which is helpful for cash flow if you keep a close eye on them. | – Someone must physically collect it, which presents logistical and physical contact challenges. – There’s room for error: it can get lost, stolen, or miscounted. – Not secure. If it’s lost, there’s no way to retrieve it. – Can be inconvenient for younger demographic clientele. – You need to deposit the cash to pay your employees, loans, and vendors. |

| Check | – A low-cost processing option. – A preferred method for older clientele demographic. – Payments are more secure because the check is made out to your business. – Customers can send payment in the mail. – You can e-deposit checks, which makes depositing them more convenient than cash. – Payments are deposited directly to your bank account, which is helpful for cash flow. | – Check processing can take between 2-5 business days to officially complete. – Can be inconvenient for younger demographic clientele. – They can get lost in the truck or the mail, or forgotten at a jobsite. – You need to retrieve them from your customers and employees, which presents logistical and physical contact challenges. – Customers can put stop payments or post-date their checks if they want to control when (or whether) the money goes through. – You need to deposit them to retrieve funds, and sometimes, the checks can bounce. |

| Credit or debit with a payment processor | – You have access to funds right away if you use instant payouts. Otherwise payments take 2 business days to process on average. – You can get low and fixed-rate credit card processing fees depending on your payment processor. – Payments are deposited directly to your bank account, which is convenient and helpful for cash flow. – A contactless payment option. – Is a preferred method for most clients (especially younger demographic clientele). – It shows clients that you’re serious about making payment easy for them. – Considered the new normal, and is a consumer expectation. – Using a trusted vendor, like Jobber Payments, allows you to vault and save your client’s card information and instantly charge them. | – Instant payouts are convenient, but they also cost 1% on top of your plan-based processing rate to access funds quickly. – Some card processors will charge you hidden fees that can add up and cost you much more than expected. – You will always pay processing fees. However, some payment processors, like Jobber Payments, will offer competitive flat fees per transaction. – There is a processing period between 2- 5 business days before you can access funds. This window shrinks to 2 business days once you’ve regularly worked with a card processor. – You might have to deal with chargebacks and fraud depending on the credit card processor you choose. Chargebacks happen when a customer doesn’t recognize a transaction and they call their credit card company to reverse the charge. Jobber Payments customers have access to our Customer Support team dedicated to helping you with disputes and chargebacks. |

| E-Transfer or EMT | – Extremely fast and convenient. – Funds are debited instantly, and guaranteed. – Clients can send an e-transfer by text or email. – Payments go directly to your bank account. – Attractive to some customers who don’t have credit cards. – A contactless payment option. | – Can cost you a fee depending on your financial institution’s discretion. – You may be susceptible to phishing scams, hacking, and theft. – Not supported by some payments processors, which can result in an inefficient accounts receivable workflow. – Requires more client communication to securely accept, transfer, and deposit the funds. |

| Digital/mobile wallet | – Extremely fast and convenient. – A contactless payment option. – Very secure because they rely on tokenization (a single-use credit card number to process the transaction). – Reduced chances of fraud because the consumer must verify their identity to make the transaction. | – You need an NFC-capable credit card terminal or POS, which can cost you extra money, and pigeon-hole you into using specific payment processor providers. – Not supported by some payments processors, which can result in an inefficient accounts receivable workflow. |

How online and offline payment options work

Cash

Cash is a straightforward offline option. Your customer hands it over to you after your service is complete. If you’re on the jobsite when they are, then you can have cash in hand right away. Otherwise, you may have to collect it later.

You’ll have to deposit the cash to use it for bill payments, but you will have the funds in hand immediately.

Checks

Checks are another common offline payment option that older clientele demographics prefer.

After you complete a service, your customer will write you a check and hand it over. They might even leave you a pre-written (or post-dated) check for you to find on their property if they’re not available to pay you after your service. In some cases, they might even mail you one.

Checks make your clients’ funds available to you (if they have sufficient funds in their bank account), but they must be processed for you to access those funds.

Your bank and your clients’ bank go through a verification process to vet it against fraud, and ensure that your client has sufficient funds in their account to transfer the money.

When you deposit a check, you technically have the money in your account, but the check could bounce if it fails these tests.

Until your bank receives confirmation, the funds you have access to from the check are actually a cash advance from your bank.

The process can take anywhere from 2 – 5 business days to get the payment into your bank account and for the check to officially clear.

Credit or debit using a payment processor

Both credit and debit payments are online payment methods.

The moment your client enters their card data by tap, swipe, or online payment, your payment processor (like Jobber Payments or Square) reads and transmits this data to the credit card network.

Your payment processor facilitates the transaction between your client’s bank, their credit card issuer, and the credit card network.

Multiple parties (payment gateway, acquirer, card processing network, issuing bank, and cardholder account) check this transaction data before it’s deposited into your account.

READ MORE: How to accept credit card payments on your phone

Every step along the way costs transaction fees (anywhere from 0.0019% – 0.025%). These fees are usually baked into your payment processor’s rate, but some processors have hidden fees that they tack on to your transaction costs to cover them.

You only get the funds deposited after this entire process. This can take anywhere from 2 – 5 business days.

However, if you choose to use instant payouts, you can get access to funds from paid invoices within seconds of requesting them.

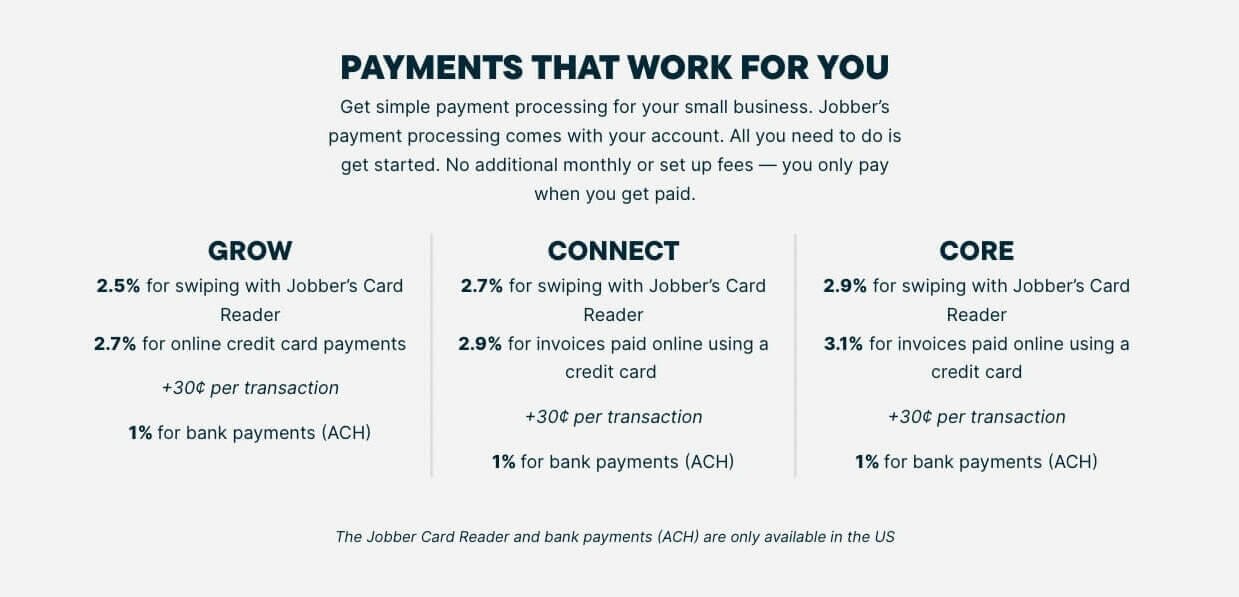

Jobber Payments transaction fees

Jobber Payments does not have any hidden fees. This means that you don’t have to worry about credit card network fees, chargeback fees, interchange fees, processing minimums, or dues and assessments fees. We cover all that for you.

Our rates are structured based on the plan you’ve subscribed to and you pay exactly what you see. They are as follows:

Jobber Payments users also have access to the following:

- Instant payouts that give you access to funds from paid invoices in your bank account within 0.4 seconds on average.

- A Support team dedicated to helping you with disputes and chargebacks.

- Card Account Updater that will automatically update expired or renewed card information for saved customers or whenever a customer receives a new card.

- Smart Retries, which chooses optimal times to retry failed payment attempts (up to four times). This helps you increase your clients’ chance of successfully paying their outstanding invoice.

Interac e-Transfers or Email Money Transfer (EMT)

E-Transfers are also an online payment method.

An e-Transfer transfers money from one banking account to another using instructions (either through text or email), and password protection.

Sometimes there is a surcharge (usually up to $1.50), but this is charged at the discretion of the sender and recipient’s banking institutions. Sometimes e-Transfers are free.

E-Transfers can transfer funds anywhere from instantly to within a few hours.

Digital/Mobile Wallets

This is another online payment option.

Apple Pay, Samsung Pay, and Google Wallet are some of the most common digital or mobile wallets. This technology uses contactless radio near field communication (NFC) technology to transmit data.

Mobile wallet payments use the same process as credit and debit card processing. They are also facilitated by your payment processor. The processing fees for digital or mobile payments differs between credit and debit processing fees, and different payment processors.

It can take anywhere from 2 – 5 business days to get payments into your bank account.

Best payment options to help you speed up cash flow

Each payment method can be a great option for your business, and your customers—never lose sight of that!

Choosing the best payment option for you depends on your business needs, and what timelines you’re able to work with. So, choose what’s right for you.

READ MORE: How to offer financing to customers

1. Debit and credit, plus instant payouts

If cash flow is your top priority, then consider accepting credit and debit payments as your top priority.

They’re a convenient payment method for your clients, and you can easily accept payments in the field or online. The funds deposit directly into your bank account within two business days on average.

Plus, when you choose Jobber Payments as your credit and debit payments processor, you have access to instant payouts. You can have funds in your account immediately whenever you need them.

Instant payouts will give you access to funds from paid invoices within seconds of the payment request—that’s faster than a cash payment handoff!

Plus:

- It’s easy to keep track of bookkeeping and accounting with credit and debit transactions. You simply have to look at your bank statements.

- You can access all your payment, invoice, and accounts receivable information right in your Jobber dashboard

- You can accept payments in the field with a Jobber card reader, which reduces the cost of your processing fees.

- You don’t need to set up logistical plans to get paid.

- Collecting accounts receivables is fast. You can include a link to pay right in your invoice

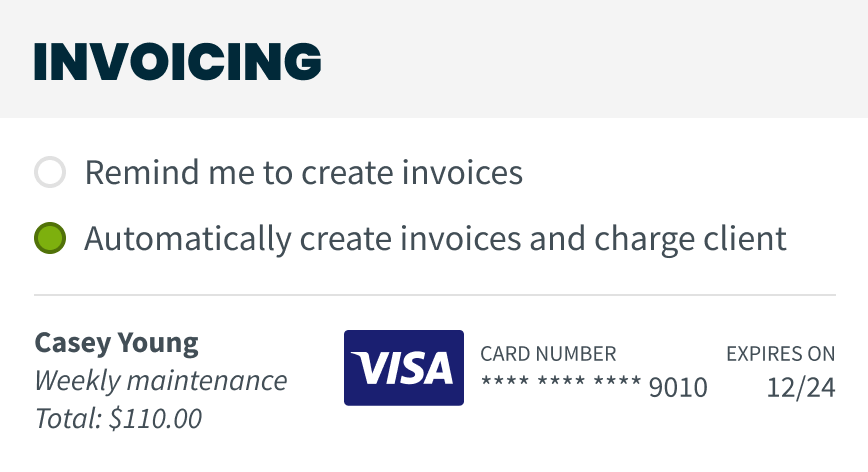

- You can vault client credit cards. This way, you only have to ask for their credit card information once, and then you keep it on file in a high-security virtual vault.

- Customers can choose to pay online if they’re not around when you’re on the jobsite.

READ MORE: How to collect payment from customers

Pro Tip: We recommend asking all your clients to pay their invoices with debit or credit payments. If every payment is in one place, then things are faster for you. This can improve your bookkeeping and accounting efficiency and workflow.

2. E-transfer

E-Transfers are a fairly effective payment solution for cash flow. They are processed quickly, and are convenient for clients. Since the money is deposited directly into your bank account, it’s easy for you to track your cash flow.

However, this isn’t an automatic payment option, like Jobber Payments. This means that you can’t automatically charge your clients. You also need to coordinate getting security questions and answers to get paid.

With credit and debit payments, your funds just show up in your bank account when your client pays their invoice. Everything is documented in your dashboard, so you can track which invoices have been paid or not, and which deposits are accounted for.

3. Cheque

Next up is cheque payments. This might surprise you, but accepting cheque payments is better for cash flow in the long run compared to cash.

Although cheque payments are slower to process, they are less of a liability than cash.

Yes, you still have to pick up a cheque or wait for it in the mail. However, if a cheque gets lost or stolen, it’s less likely that you’ll be at a loss than if it was an envelope of cash.

The only drawback is that you’ll have to explain why you need a new cheque to your customer if you ever misplace it.

4. Cash

Yes, cash is really great for cash flow. However, it presents a lot of liabilities. If the cash payment gets lost, misplaced, or stolen, then you have a huge cash flow issue on your hands.

The biggest reason why you might want to prioritize cash for cash flow reasons is because you will have money on hand immediately. However, this doesn’t take into account how and when you actually get the cash.

Some businesses (like restaurants) require customers to pay at the POS. This gives them access to cash immediately. However, home service business owners might need to wait to get cash in hand unless their client is at the jobsite to pay them.

If you do decide to work with cash, make sure you are keeping your books in order. Things can get messy if you don’t keep track of incoming and outgoing money.