Overdue Payment Reminder Email: 6 Templates to Get Paid Faster

Sending an overdue payment reminder email is an easy way to give slow clients a nudge and help you get paid faster for the work you’ve done.

While following up about overdue payments can feel awkward and uncomfortable, it doesn’t have to be. In this guide, we’ll walk you through six polite and professional email templates that you can use to collect payment for overdue invoices.

Stop chasing payments and automate your follow-ups. Try field service invoicing software today.

For more advice on preventing late payments, watch this episode of Ask a Business Mentor and hear follow-up tips from experienced business owners:

Payment reminder email templates and when to send them

Sending a friendly payment reminder letter or email can help you receive timely payment for outstanding invoices.

Copy and paste these payment reminder templates to send a polite reminder to customers with overdue or unpaid invoices.

READ MORE:How to write an invoice: look professional and get paid faster

Before payment is due

Send an invoice reminder email two to three days before your invoice due date to prevent late payment.

If you’re following up on an invoice for a repeat service, like lawn care or cleaning, this is also an opportunity to recommend your customer set up recurring payments.

Use this template to remind your customers that their payment is almost due:

Subject line: Upcoming payment reminder from [BUSINESS NAME]

Hi [CUSTOMER NAME],

Hope you are doing well. This is just a friendly reminder that payment for your unpaid invoice [INVOICE #] is due on [PAYMENT DUE DATE].

I’ve reattached the invoice for your reference.

Please feel free to contact me if you have any questions about the invoice, or if you’d like to arrange your payment. We accept the following payment methods: [PAYMENT METHODS].

Thank you for your business,

[BUSINESS NAME]

On the invoice due date

Send a simple, professional invoice follow-up on your invoice due date in case your client forgot to make a payment earlier, or has a question about the invoice they’ve been meaning to ask.

Keep your tone friendly, polite, and straightforward, and make sure to include important information like the amount due, the invoice number, and how to pay it.

Subject line: Payment reminder from [BUSINESS NAME] – Due today

Hi [CUSTOMER NAME]

I just wanted to quickly remind you that the invoice [INVOICE #] for [$0.00] is due today. I’ve reattached the invoice for your reference.

You can make an invoice payment today via [CASH, CREDIT CARD, ONLINE PAYMENT] to avoid being charged a late fee.

Please do not hesitate to reach out if you have any questions about the invoice or how to set up a payment. I can be reached at [PHONE NUMBER] or by email at [EMAIL ADDRESS].

Thank you for your business,

[BUSINESS NAME]

One week late

Now that the invoice is officially overdue, it’s time to switch up your tone and go for a more direct approach.

Include important details from the invoice, like the invoice number and amount due, and attach a copy of the original invoice in case it was accidentally lost or deleted.

Subject line: Past due payment reminder from [BUSINESS NAME]

Hi [CLIENT NAME],

We’re following up on the overdue invoice [INVOICE #] for the amount [$0.00], which was due on [INVOICE DUE DATE]. We’ve attached a copy of the invoice for your reference.

To avoid any additional late payment fees please make a payment via [ACCEPTED PAYMENT METHODS].

If you have any questions about the invoice or how to arrange payment, you can contact us by:

Calling our office [PHONE NUMBER]

Emailing us at [EMAIL ADDRESS]

Visiting our office at [OFFICE ADDRESS]

Thanks,

[BUSINESS NAME]

Two weeks late

By now, you’ve likely reached out more than once to remind a client to pay the invoice without receiving a response, which can be frustrating. It’s still important to keep your messaging professional and to the point—even when dealing with difficult customers.

The purpose of this letter is to get the client to respond, either by reaching out to you to offer an explanation or by paying off the invoice.

Subject line: Overdue payment reminder from [BUSINESS NAME] – Due immediately

Hi [CLIENT NAME],

We’ve made several attempts to reach you regarding payment for the outstanding invoice [INVOICE NUMBER]. The total amount owing is [$0.00] and was due on [INVOICE DUE DATE]. You are now [TWO WEEKS] past due.

We have attached a copy of the original invoice for your reference.

To avoid interest fees or late charges, please get in touch with us to arrange payment by:

Calling our office at [PHONE NUMBER]

Emailing us at [EMAIL ADDRESS]

Visiting our office at [OFFICE ADDRESS]

You can also make payment in full via [ACCEPTED PAYMENT OPTION].

Thanks,

[BUSINESS NAME]

One month late

When a client is more than one month late, your payment letter becomes more of an accounts receivable collections letter. Keep your messaging professional and to the point.

The purpose of this letter is to get your customer to respond with payment or start a conversation around when you can expect to be paid for your services.

Subject line: URGENT – Overdue payment reminder from [BUSINESS NAME]

Hi [CLIENT NAME],

We’re sending this third payment reminder to let you know that your invoice [INVOICE #] for [$0.00] is now one month overdue.

As stated in our payment terms, we will be charging a late payment fee of [$0.00] for payments made 30 days past due.

See the attached invoice for all the payment details.

Please get in touch with us as soon as possible to arrange payment by:

Calling our office at [PHONE NUMBER]

Emailing us at [EMAIL ADDRESS]

Visiting our office at [OFFICE ADDRESS]

You can also make payment in full via [ACCEPTED PAYMENT OPTION].

Thanks,

[BUSINESS NAME]

Final notice warning

If your previous emails have gone unanswered, it’s time to send one final reminder to let your customer know you’ll be seeking further action if the invoice isn’t paid by a certain date.

Subject line: FINAL NOTICE – Urgent action required for overdue invoice from [BUSINESS NAME]

Hi [CLIENT NAME],

We’re sending this final notice in response to the outstanding balance for invoice # [INVOICE #], which is now [# of days] days overdue.

If there are any issues or concerns we are unaware of, please let us know as soon as possible.

However, if we do not receive payment or a response within the next [#] of days, we’ll need to take further actions to collect this outstanding payment.

See the attached invoice for all the payment details.

Please get in touch with us as soon as possible to arrange payment by either:

Calling our office at [PHONE NUMBER]

Emailing us at [EMAIL ADDRESS]

Visiting our office at [OFFICE ADDRESS]

You can also make payment in full via [ACCEPTED PAYMENT OPTION].

Thanks,

[BUSINESS NAME]

What to include in your payment reminder message

Whether you chose to send one of the email samples above, or write your own payment reminder emails, your overdue payment letter should include:

- A copy of the unpaid invoice that includes an invoice number, amount owed, due date, date issued, and payment terms

- Contact information, such as your company phone number and email address

- Your preferred payment methods (like VISA, Mastercard, cash, or check) and instructions on how to pay

- Late fees or interest charges that may be applied to overdue invoices

- Polite sign-off, like thanks or warm regards

READ MORE: What to include on an invoice: must-haves to get paid

How to send a payment reminder email

If you’re planning on manually sending payment reminder emails to your clients, simply copy and paste one of the templates above into the body of your email, fill in the blanks, and hit send.

Or, try Jobber’s invoicing software to automatically send overdue payment reminders to your clients and get paid faster.

Here’s what that process looks like:

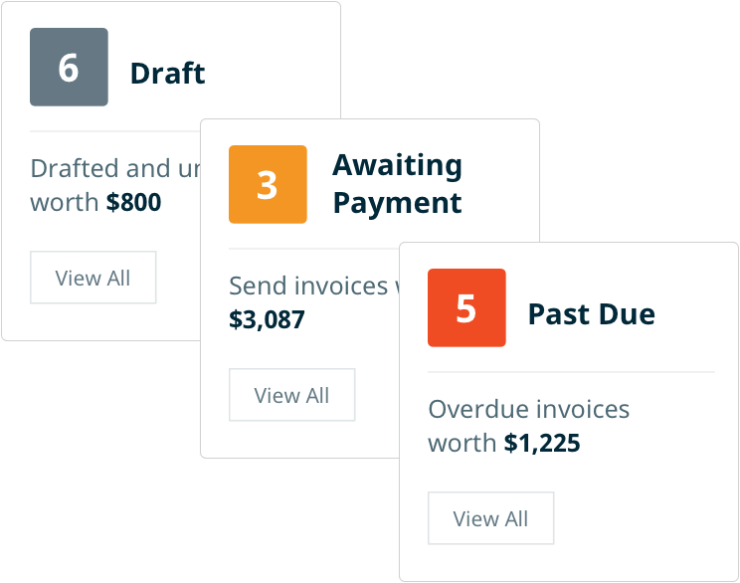

- Track the status of your invoices at a glance to see which ones have been sent, which have been paid, and which invoices are overdue.

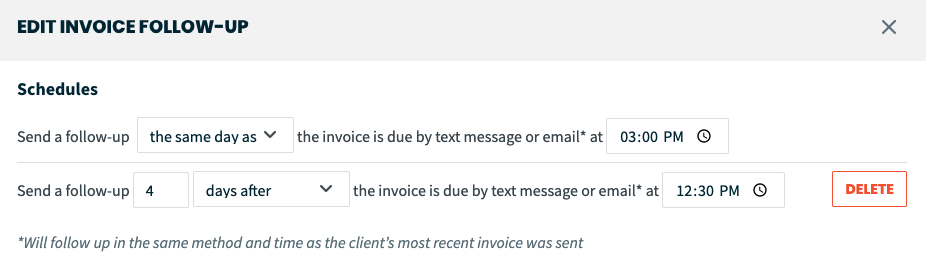

2. Choose when to send automatic payment reminders.

3. Customize your invoice follow-up message using the templates above.

Here’s what your client will see:

Overdue payment reminder email example

Overdue payment reminder text message example

Automating your invoice reminders with Jobber lets you:

- Spend less time manually sending payment reminders

- Get paid up to 10x faster

- Easily track the status of your invoices at a glance

- Provide customers with an easy way to pay their invoices online

Best practices for sending overdue payments reminders

Sending overdue payment reminders is an important part of managing your accounts receivable.

Follow these best practices to improve cash flow and preserve your customer relationship:

1. Make sure your client received the invoice

Before sending a payment reminder email to your clients, double check they received the initial invoice, and that it didn’t bounce back or go to the wrong or incorrectly spelled email address.

2. Provide payment options

Make it easy for your client to settle their debt by providing various payment methods, like convenient credit card processing and clear instructions for making a payment.

3. Be polite

Overdue payments can be frustrating, but keeping a polite and professional tone goes a long way to preserve your business’s reputation and maintain a positive relationship with your clients.

4. Use the right communication channels

Different clients prefer different methods of communication. If your clients typically request work via email, sending reminder emails is the best way to go. If they strictly call in for work requests a phone call or text message may be a more effective option.

5. Offer assistance

Let your clients know you’re here to help with any payment problems or invoice concerns they might have. This shows that you genuinely care about their situation and your customers will appreciate the support.

By developing a payment reminder strategy that includes payment terms and automated reminders, you can spend less time chasing payments and more time getting the job done.

Use Jobber’s field service invoicing software to set and forget payment reminders that are automatically sent for every overdue invoice—whether they’re behind by a day or a week.

Originally published in January 2021. Last updated on October 25th, 2023.