How to Set Late Fees on Invoices (Free Templates)

Late payment fees encourage customers to pay faster—they’re a great way to prevent missed payments and improve cash flow.

If you’re ready to set late fees on your invoices, how do you choose a late fee that’s fair and encourages quick payment? And what’s the right way to share a late payment policy with your customers?

Follow this guide to learn how to choose the right late fees and create a detailed late fee policy—and use our free email templates to communicate your policy to customers.

How much can I charge for late fees?

A standard late fee for invoices that are overdue is between 1% and 2% monthly. Flat rate fees should depend on how much you typically charge customers.

You can charge late invoice payments either as an interest rate, a flat fee, or both. Here’s a breakdown of those fee structures with late fee examples:

- Interest rates are the most common late fee structure—they penalize customers fairly for all bill sizes. Charge a percentage of the owing balance each day, week, or month after the payment deadline.

- Example: For a $500 invoice with a monthly interest rate of 2%, the customer will owe you $502.50 after the first week and $510 after 30 days.

- Compound interest: For more severe late fees, charge interest on the customer’s balance including the interest they’ve accumulated.

- Example: If you charge compound monthly interest at 2% each day, you’ll add an additional 2% interest to the latest balance (e.g., $500 will grow to $510 after one month, then $510 will grow to $510.20 after a month and a day).

- Flat rate: Charge customers one fixed price every week or month until they pay. Flat rate fees are easier to calculate, but you should set different rates to charge fairly depending on bill sizes.

- Example: Charge $10 for invoices under $500, and $18 for bills over $1,000.

- Hybrid: One universal flat rate might be too high for customers with smaller bills, and sometimes interest rates aren’t enough to discourage late payment.

- Example: Charge $15 for the first 30 days of nonpayment, then compound interest at 2% after that.

Disclaimer: Check your state’s usury laws to see if there’s a limit to the interest rates you can charge.

Can you legally charge interest on overdue invoices?

It’s legal to charge interest on an overdue invoice as long as you outline it in your contract with the customer.

Your customers need written proof of your late payment policy to understand and follow your payment terms. A written record will also protect you in the event of a dispute.

How to calculate late fees on invoices

To calculate a late payment fee, multiply your interest rate by the invoice total.

Let’s say a customer owes $700 on an invoice, and you charge 1.5% monthly in interest for late payments. For every 30 days the invoice goes unpaid, you add an additional 1.5% of the initial balance every month. Here’s how to calculate the new balance:

0.015 x $700 = $10.50

$700 + $10.50 = $710.50

After 30 days, your customer will owe you $710.50. If the customer still doesn’t pay after 60 days, you’ll add another $10.50 to their balance, and that will total to $721.

To charge that interest daily, divide the initial interest charge ($10.50) by the number of days in the month:

$10.50 / 30 = $0.35

In this case, you’ll add $0.35 to the customer’s balance every day until they pay.

If you choose to charge compound interest, the next additional charge will be 1.5% of their last balance, including the accumulated interest. So, after 60 days, this customer will pay interest at 1.5% on their $710.50 balance.

0.015 x $710.50 = $10.66

$710.50 + $10.66 = $722.16

How to create a late fee policy

A late payment fee policy tells your customers what your late fees are, when late fees take effect, and all other details on how they’ll be penalized for late payments.

To create a clear late fee policy, figure out these details:

- How much will you charge in interest, as a flat rate fee, or both?

- When does your policy come into effect? Will you charge late fees immediately after the deadline passes, or give a grace period of a few days?

- How often will you send payment reminders after the payment deadline? (e.g., every day, every three days)

- Are there any exceptions to your late fee policy? (e.g., you should accept late payments due to personal tragedy or other uncontrollable circumstances)

Once you’ve decided on these terms, write a paragraph that outlines them and include it in your contracts and invoices. Use this late fee policy template as a starting point:

Late fee policy template

By signing this payment policy, you agree to pay all invoices from [YOUR BUSINESS NAME] within [NUMBER] days of the date the invoice is sent.

Overdue invoice balances will be subject to a late payment fee of [INTEREST RATE / FLAT RATE] per month, which will be charged daily until the owing balance is paid.

If you are unable to make a payment for reasonable circumstances that are out of your control, contact us at [PHONE NUMBER] and we will discuss alternative options.

How long should you give someone to pay an invoice?

Give customers 7–14 days to pay invoices if you want to get paid quickly and need regular cash flow. Some customers will miss your payment deadline, so setting shorter deadlines will guarantee you get paid more regularly.

If your services are more costly or if you’re not in a rush to get paid, you can set your payment deadline to net 30 (30 days after you send the invoice).

For overdue invoices, allow a grace period of one week before you start charging late fees. One week is enough time to warn a customer over the phone if your payment reminder emails haven’t worked.

How to communicate your late fee policy to customers (with email templates)

First, send an email to announce your late fee policy to all your customers. If you add this policy to your invoices without telling your customers beforehand, they might miss the message and get caught off guard by late fee charges.

Use this email template as a starting point to announce your new late fee policy:

Email template: late fee policy announcement

Subject: New late fee policy

Hi [CLIENT NAME],

As of today, we will begin charging a late payment fee for missed invoice payments. Overdue balances will be subject to a late payment fee of [INTEREST RATE / FLAT RATE] per month, which will be charged daily until the owing balance is paid.

If you are unable to make a payment for reasonable circumstances that are out of your control, contact us at [PHONE NUMBER] and we will discuss alternative options.

Let us know if you have any questions about our late payment policy. As always, we value your business and are happy to work with you.

Thank you,

[BUSINESS NAME]

[EMAIL SIGNATURE]

Remind every customer about this late fee policy when you meet them in person or on the phone, too.

Next, add your policy to the bottom of your invoices as part of your payment terms. Here’s an example of a late payment fee disclaimer you can add to your invoices:

Late fee wording on an invoice: interest rate

All payments must be met by the payment deadline listed on the invoice. Balances that are unpaid after the payment deadline are subject to a fee of [INTEREST RATE / FLAT RATE] on the owed amount every month, charged [DAILY / WEEKLY] until the balance is paid.

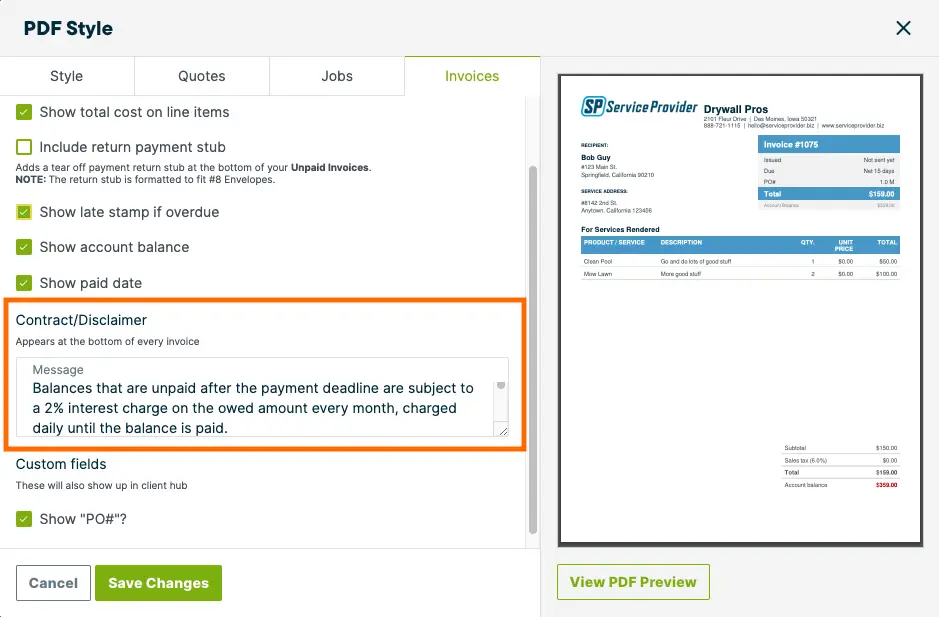

Using invoicing software like Jobber, you can create a default disclaimer message so that your late payment policy message appears on all your invoices:

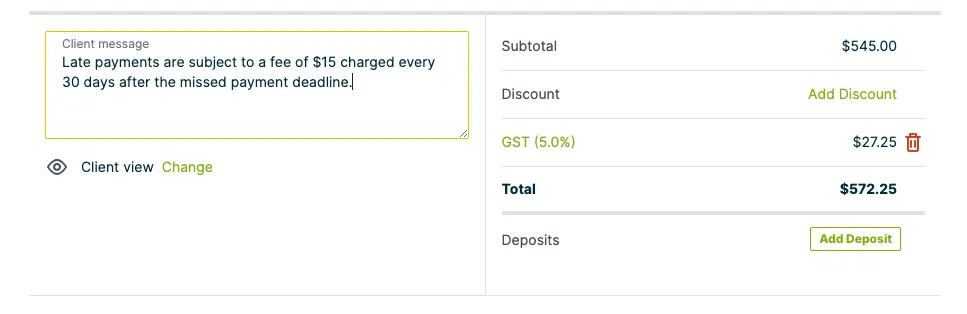

If you want a different late payment message for specific customers, you can edit the message directly in your Jobber invoice before you send it:

FREE TOOL: Create a quick invoice with payment terms using our free invoice generator

To apply your new late payment policy on an existing job or project, have the customer sign an updated contract or estimate that includes your invoice payment terms.

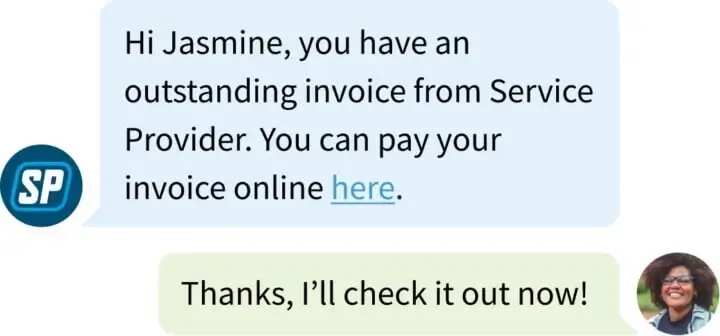

Once customers know about your late fee policy, send automated payment reminders over text or email. Use Jobber to customize and send follow-up messages that gently remind customers to pay their outstanding invoices.

Jobber’s payment reminder messages include a link to the invoice, which customers can pay with convenient, touchless payment options.

What to do when late payment fees don’t work

When your customer still won’t pay after you’ve charged late fees and followed up consistently, you have three options:

- Offer a payment plan. If a customer is struggling financially, offer customer financing to help them pay. It’s better to get paid in installments than not at all, and your client will appreciate your understanding and flexibility.

- Pursue legal action. Hire an attorney if a customer’s missed payments have seriously hurt your small business. A lawyer can reach out on your behalf or help you in small claims court if you choose to move forward with a lien or lawsuit.

- Hire a collection agency. Debt collectors chase down customers for you—usually for debts that are 60 or more days overdue—and charge you either a percentage of the debt or a flat fee per account that you need them to collect on.

To avoid late-paying customers in the first place, improve your payment and invoicing strategy from day one by:

- Creating professional invoices with clear payment terms

- Offer early payment discounts

- Sending invoices immediately after you’ve sold your products or services

- Track the status of all your invoices at a glance in your invoicing software

- Send consistent payment reminder emails and texts

- Provide invoice financing options to customers who need help paying

- Provide a variety of payment options, including online payments and credit card processing

Originally published in October, 2021. Last updated on March 31, 2023.