How to Politely Ask Clients For an Upfront Deposit (With Examples)

Asking for a deposit upfront is a smart way to boost working capital, keep clients invested in a project, and ensure you have money to cover your own business expenses.

But asking for money upfront before a job has started can feel like a bold move—especially if you’ve never done it before.

Plus, how, when, and which clients you ask all impact your success. That’s where this article on asking for deposits upfront can help.

Want to know more? Watch this episode of Ask a Business Mentor to learn the ins and outs of asking for deposits from four experienced entrepreneurs:

Why you should ask for a deposit

Deposits are relatively common in many industries, but here are some of the most important ways they can benefit service businesses like yours.

1. Deposits improve cash flow

Deposits are one of the best cash flow strategies you can employ to foster healthy and consistent capital. When you ask for a deposit before a job starts, it ensures that you have the cash to cover your expenses before the job is done.

This is especially handy when it comes to long-term projects or jobs that experience delays.

When you have dependable cash flow, you can cover your bills, plan your small business budget, and access funds to cover unexpected costs, like repairs.

2. Deposits reduce non-payments

Unpaid invoices are a headache to deal with. Not only do you have to worry about covering your expenses, but you also have to develop a strategy to collect payment from any customers who won’t pay their invoices.

And, as much as the threat of late payment fees is motivation enough for some clients to pay, it doesn’t always work.

Enforcing an upfront fee, like a deposit, ensures that a customer is invested in a project or job from the get-go. Clients who have already paid for part of a job are less likely to skip or miss payments down the road.

And, you’ll already know that they have a reliable payment method to use in the future. This means that if a client uses a credit card, you can store the information (with their permission), and use it to pay their next invoice.

READ MORE: Accounts receivable collections: strategies for small businesses

3. Deposits provide funds for materials and supplies

From lumber and cleaning items to tools and lawn care equipment, many service providers have to cover supply and materials costs related to each job they take on.

Deposits are a great way to avoid having to cover these expenses out of pocket before a job is finished. For example, if a client hires you to build a deck, a deposit can help you pay for the lumber using the client’s money instead of your own.

This keeps your cash flow from being stretched thin to cover client-specific expenses.

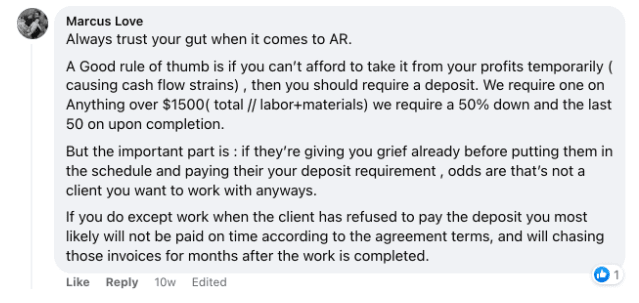

4. Deposits filter out bad clients

If a customer isn’t willing to pay a deposit, it doesn’t bode well for their ability (or willingness) to make payments in the future. And, it’s much easier to say no upfront than to figure out how to fire a client later on.

Deposits act as a gatekeeper when it comes to potentially troublesome clients. If a client can’t or won’t pay the initial deposit, how do you know they’ll pay your final invoice when it’s due?

Although it may feel uncomfortable to turn down a job, if a client is having trouble making payment before it even starts, you’ll probably end up saving yourself a lot of time and stress by sticking to your guns.

Pro Tip: Consider offering consumer financing to customers who you want to work with but who don’t have the upfront funds.

When to ask for an upfront payment

You don’t need to ask every single client for a deposit on every single project. Instead, follow these guidelines to ensure you’re requesting deposits at the right times.

1. Request a deposit before a job starts

Deposits are typically requested and paid before any work is done—not halfway through a job. Think of it as a sort of upfront payment to help you cover costs associated with the job.

Asking for money halfway through a job is bad practice unless it’s detailed in your payment terms and the customer is notified in advance.

2. Ask new clients for a deposit

Many service providers only make deposits a requirement for new clients and contracts. It doesn’t make sense to ask for deposits from existing clients unless you’re taking on a new project with them that’s going to cost a lot of money or take a significant amount of time to complete.

A good rule of thumb when starting with deposits is to only require them from new clients.

3. Only use deposits for certain projects or thresholds

Asking for deposits based on projects or thresholds might be the most common approach service businesses take.

If you offer some low-cost services, asking for a deposit may not be practical. For example, some service providers only ask for deposits on jobs over $1000, while others ask clients to pay for the complete cost of materials upfront. Here’s Marcus’s approach:

If you have a client who needs a simple job done and the final invoice will come to less than $500, consider whether a deposit is necessary, just like Joshua does:

When setting up deposits for the first time, go through your service list and determine which jobs will require deposits and which won’t. Then, when clients ask for a quote, it’ll be easy to determine whether a deposit is due.

Get advice from real home service professionals about deposits and more in the Jobber Entrepreneurship Facebook Group.

4. Stick to state law

All U.S. states have different limitations when it comes to deposits that businesses can request from customers. Before choosing an amount or percentage, check your state’s requirements or ask your accountant to ensure you’re operating within the law.

Professional ways to ask clients for a deposit

To boost your chances of getting a hassle-free deposit with no pushback from customers, here are some polite ways to ensure your request is accepted:

✔️ Use friendly and professional language

✔️ Provide lots of notice for the payment

✔️ Communicate clearly about the amount due, payment deadline, and accepted payment methods

✔️ Include details about deposits in your contracts, quotes, and invoices

Here are some examples you can customize for deposit requests in emails and in your payment terms:

Ask for a deposit via email

It’s best practice to send an invoice when requesting a deposit. This shows clients exactly how much the total amount of the project is and how much they are required to pay in advance. But you can’t just send an invoice with no context.

Instead, you need to include an email that outlines the deposit amount, due date, and how to pay it. Use this sample letter template to get you started:

Hi [Client Name],

Thanks again for reaching out to us, the team at [Company Name] is looking forward to working with you!

Attached to this email, you’ll find a copy of invoice [invoice number] for [description of work]. The total amount is [$0.00] and a deposit of [$0.00] is due by [due date of deposit].

Payment can be made via [credit card] by [payment instructions].

Once you’ve paid the deposit, we’ll get in touch to schedule a start date.

If you have any questions or concerns, please don’t hesitate to reach out via [phone number] or [email address].

Thanks!

[Your Name]

[Company Name]

READ MORE: How to write an invoice

Include deposits in your payment terms

Payment terms help you to include important information about deposits on quotes and invoices as well as in your contracts. They’re typically short and straightforward, and use the same or similar wording across all three documents.

Here’s an example of a payment term you can include in your quotes to communicate your deposit:

A [percentage] deposit is due [X days] after a quote has been issued.

This line can be used in the payment terms outlined in your quote, in the contract a client signs, and in the first invoice you send to a client before any work is done.

Using job quoting software you can build custom quotes that include all of your payment terms as well as your deposit amounts and due dates.

How much to charge?

How much you charge for a deposit depends on a variety of factors, including where you live and the cost of a job. But there are some simple, go-to ways that small business owners calculate deposits on jobs:

- 20-50% of the total cost of a job

- 100% of the cost of materials

- 50% of any job over $1000

- Standard, nonrefundable $250 fee

Putting deposits to work

Quotes do a lot of heavy lifting in your service business. From improving your cash flow and helping you to avoid an unpaid invoice to filtering out bad clients and covering the cost of supplies—there’s really no downside to making deposits part of your quoting process.

As long as you communicate about your deposits clearly, include them in your payment terms, and make a polite request, they’ll bring your business a ton of long-term benefits.