5 Important Steps to Take When a Customer Won’t Pay for Services

As a home service business owner, you rely on your clients to pay you on time and in full so that you can keep things running smoothly. But what happens when a payment due date goes by and your customer still hasn’t paid you, even though you completed the work detailed in your contract?

In this resource, we’ll walk you through some of the steps you can take when a client won’t pay for your services.

1. Get in touch with non-paying clients

The very first thing that you should do when a client misses a payment is to get in touch. There are many legitimate reasons why a customer could forget to pay an invoice, such as:

- Losing or failing to receive the initial invoice

- Personal issues, like a family emergency

- Being away for work or travel

- An incorrect email address or billing address

Often, clients don’t miss payment due dates on purpose. By reaching out to them, you can give them a polite and gentle reminder to pay without going overboard. Start by reaching out through the original method of communication you used while on the job (like phone calls, texts, or emails). If you don’t hear back, try any other contact information you have on file.

If a client is in an unexpected situation that makes it hard for them to pay their invoice in full, consider working out a payment plan together. It’s better to get paid in installments than not at all, and your client will appreciate your understanding and flexibility.

READ MORE: Learn how to deal with difficult clients

2. Resend your invoice

As soon as you realize payment is past due, resend the invoice. Invoices sent by mail or left on the doorstep are easy to lose. Even emailed invoices can be accidentally deleted or wind up in the Spam folder.

If possible, avoid resending it by mail. Digital invoices are more likely to be received and harder to lose. Emailing a PDF is one option. Or, you can host invoices on your client self-service portal. This gives you the option to send the invoice by email or SMS, or the client can log-in themselves and access it anytime. A client portal is no match for ‘Spam folder’ excuses.

Hopefully, a simple reminder will be all it takes to either encourage your client to pay or to start a conversation about how to move forward.

Pro tip: If you use invoicing software made for home service businesses (seen below), you can track invoice statuses and easily see when an invoice was sent and if it’s still awaiting payment.

3. Use structured payment reminders

It can be hard to get the messaging right, especially when you’re frustrated and don’t know what to say. Instead of winging it and sending out a message that you may come to regret, use payment reminder templates.

Here are four payment reminder templates you can save and use for when a customer hasn’t paid their invoice.

Keep copies of all communication you have with a client before, during, and after a job in case you need to use them in the future.

4. Pursue legal action

If you’ve done your best to get in touch, resent invoices, and reached out with reminders but the customer still won’t pay, it may be time to end the working relationship and pursue legal action.

Your first option is to hire an attorney to reach out to the client on your behalf. They can send a letter requesting immediate payment, including copies of the initial contract and invoices as proof of the terms of the agreement between you and the client. A lawyer can also help if you choose to move forward with a lien or lawsuit against the client who is refusing to pay.

If that doesn’t work, you may choose to take your case to small claims court, which, depending on your state, you can do with or without a lawyer. However, each state has a minimum amount (usually $2000.00) you need to sue for in order to ensure that the case is worthwhile. So, if you’re looking to collect on a smaller amount, like $500.00, you may not be able to present your case to a judge.

Legal action, like hiring an attorney or taking your case to small claims court, costs money. You should only resort to legal action for large jobs and invoices. Otherwise, you may end up spending more to collect payment than the cost of the job itself.

5. Hire a collection agency

Collection agencies typically handle debts that are 90+ days past due. If you’ve exhausted options #1-3 and determined that legal action isn’t worth it, hiring a collection agency may be a good option for you.

Collection agencies work by charging you either a percentage of the debt or a flat fee per account that you need them to collect on. Collection agencies can be ideal if you’re strapped for time or if you aren’t confident you know the rules and regulations surrounding debt collection in your state. For example, when and how you’re allowed to call a client whose invoice is outstanding.

Before you choose a collection agency, make sure to do your research by finding one that:

- Has experience making collections in your industry

- Is recommended by your colleagues or industry contacts

- Is licensed and bonded in your state

- Behaves professionally and within your state’s collection regulations

How to prevent overdue payments from clients

The best way to avoid customers who won’t pay for the work that you’ve done is to prevent these situations from happening in the first place. You can do this by:

1. Offer convenient and easy payment options

Clients shouldn’t have a hard time paying you. If you only allow payments via cash or check, arranging a payment may become a major hassle for your clients, meaning they won’t pay on time.

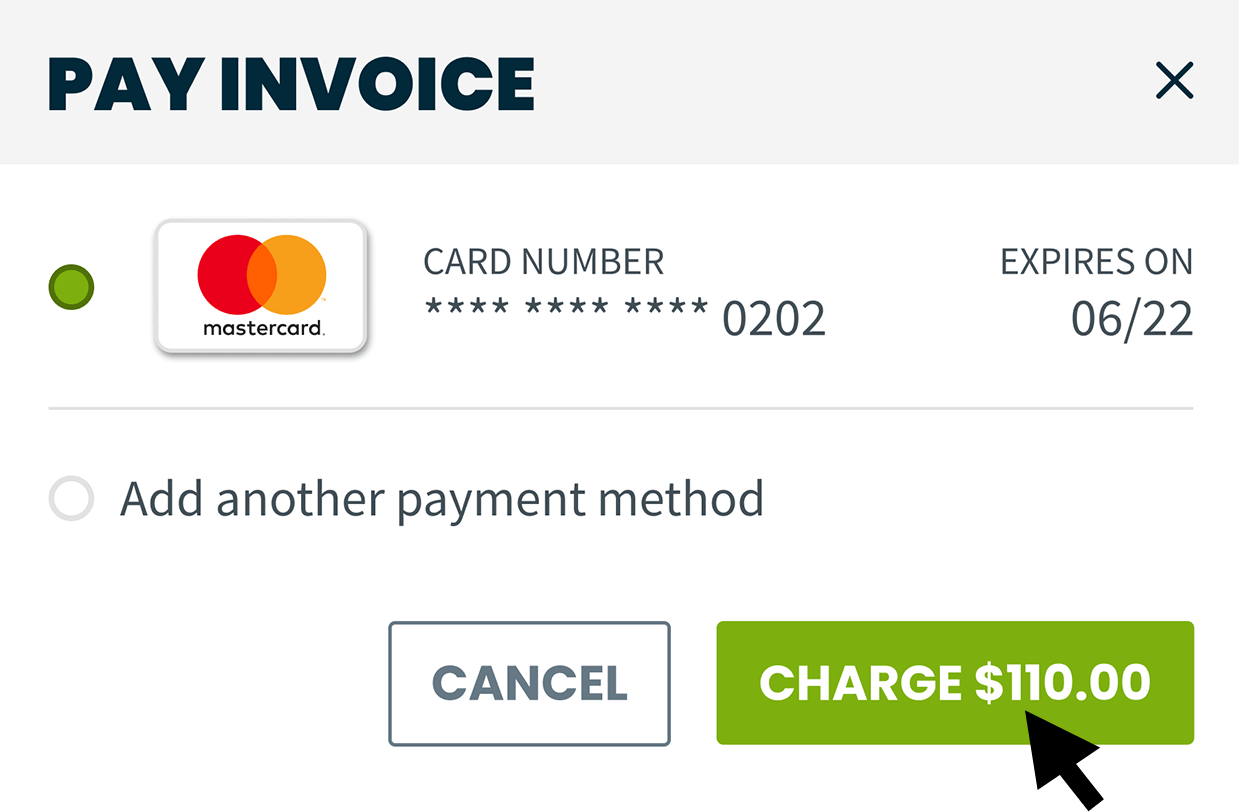

Accepting credit card payments on your phone or online make it easier for your clients to pay anytime, anywhere. Plus, your business gets access to the money faster than with cheques.

READ MORE: How to offer financing to customers

3. Collect a deposit

While a deposit won’t guarantee that your client will pay the rest of their balance on time, it will help to ensure that they have some skin in the game and that you aren’t working for free. Clients who aren’t willing to put down a deposit before work starts may cause trouble down the road.

Make deposits a requirement for any new job to help weed out bad customers from the get-go.

Don’t forget to check your state’s maximum deposit allowance so that you don’t overcharge.

4. Follow-ups and reminders

A client who doesn’t pay on time may not do it on purpose. Follow-ups and reminders can be a great way to remind a client that an invoice is due without souring your relationship.

Using Jobber’s invoicing software, you can send automatic payment reminders on every overdue invoice. Plus, you can customize your messages to include payment instructions. Remember: the easier you make it for clients to pay, the more likely they will.

Learn more about the best online payment methods for service businesses here.

5. Use professional contracts, quotes, and invoices

Professional, legally-binding, and signed documents are some of the best tools you have at your disposal when it comes to proving that a client was aware of the terms and conditions of your business relationship.

Contracts, quotes, and invoices can all be used to show a client what they agreed to, and if necessary, to prove your case in court.

Always use professional, detailed quotes, and have your clients approve them before beginning work.

Wrap things up at the end of a job by sending a detailed invoice that includes payment instructions and a reasonable due date.

This post was originally published in July 2015. It was last updated on January 18, 2021.